Here's just how driving intoxicated of drugs or alcohol might affect what you spend for insurance policy this year and also in the future. Secret Takeaways If you get a DUI sentence, you can anticipate your insurance coverage rates to rise. An insurer may select not to restore your plan when they it discovers you have a DUI on your driving record.

The prospective added costs in automobile insurance policy will certainly differ according to your situation as well as your insurance company, yet a premium rise pertaining to a drunk driving might quickly cost you thousands of bucks - sr22. In California, as an example, a teen with a drunk driving may face an extra $40,000 in insurance policy expenses over 13 years - driver's license.

Just how Long Does a Drunk Driving Remain On Your Insurance policy? A DUI isn't technically "on your insurance policy," however on your driving record, which an insurance coverage company might make use of to set your rates or approve you as a customer. A DUI can stay on your driving record for 2 to 5 years, or possibly a lot longer.

If your driving document continues to show the alcohol infraction or limitation, an insurance firm may be able to legitimately use it to avoid supplying the finest premium rates or not use the customer a quote at all - motor vehicle safety. Here are a few instances of state policies for DUI sentences:: Medication or alcohol-related offenses or sentences remain on a record for up to 15 years (driver's license).

: Alcohol-related sentences stay on your driving document for life, yet the driving documents that insurance provider utilize only reveal the previous three years' worth of convictions. When Do You Required To Tell Your Insurance Coverage Carrier Concerning a DUI? "Notify the insurance policy firm as soon as possible after the sentence in court, and also take your medication of increased premiums, as opposed to the insurance carrier uncovering the DUI/DWI," Ripley said.

The Single Strategy To Use For Sr22 — Dui Financial Responsibility Requirements - Lha

That way, you might have even more time to go shopping about for the finest automobile insurance policy rates. In numerous states, insurance coverage carriers are permitted to cancel a policy if you get a DUI/DWI, also if your policy period isn't up. driver's license.

In a lot Get more info of scenarios, you must share your DUI with your insurer - sr-22 insurance. Right here are some certain examples: When You're Trying to find A New Policy Your DUI or DWI will certainly show up on your driving document, which insurance firms check when determining whether to provide a brand-new policy and also at what price. In numerous states, an insurance provider has up to 60 days to explore your insurance application, and the right to reject or cancel your plan within those 60 days.

"You need to answer this honestly or your insurance quote/application will be retracted for misstatement," Ripley said. When You Have An Existing Auto Insurance plan Insurer will inevitably learn about your DUI at some time. This may be when they restore your plan at the six-month or 1 year mark, or when they carry out an underwriting assessment of your driving document every few years.

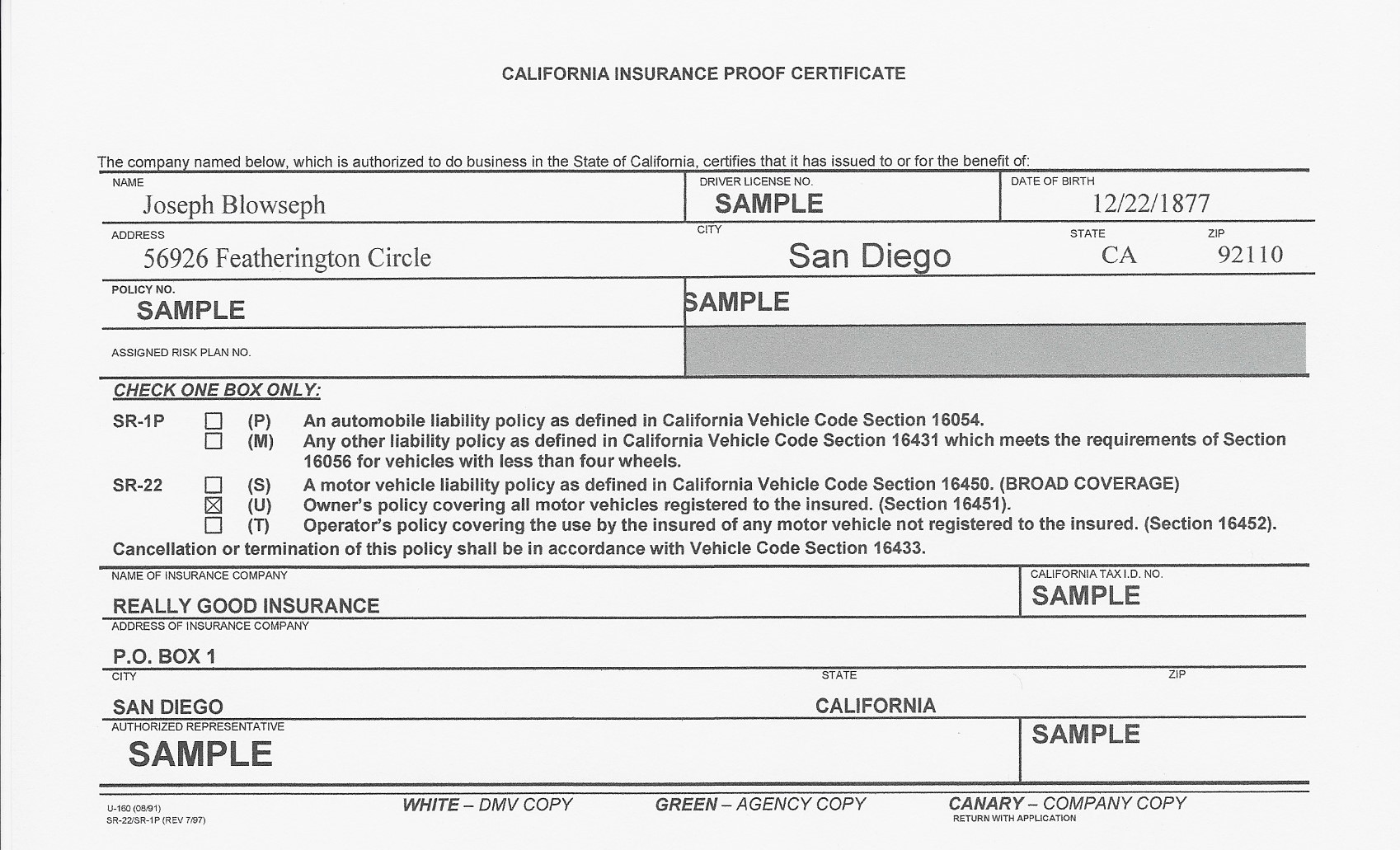

You can obtain this certificate from insurance companies that supply it, although not all do. The demand for an SR-22 certificate automatically lets the insurer understand you have an offense that the state thinks about significant. deductibles. The duration you're needed to bring the certification can differ however might vary up to 5 years (department of motor vehicles).

sr-22 insurance companies sr22 insurance coverage ignition interlock

sr-22 insurance companies sr22 insurance coverage ignition interlock

An SR-22 doesn't cost muchlikely around $25and is also devoid of some business. Beyond DUIs, SR-22s can be needed for various other major relocating offenses or driving without insurance coverage, depending upon state legislation (no-fault insurance). Just How To Locate Affordable Cars And Truck Insurance After a DUI Your alternatives for locating practical prices on insurance after a DUI are restricted - car insurance.

The Definitive Guide to How A Dui Or Dwi Can Affect Your Car Insurance - Investopedia

for chauffeurs that can not obtain minimal liability insurance coverage via the normal insurance coverage market. insurance companies. With state plans, you might be appointed to an insurance firm that has to offer you insurance coverage for the minimal liability amount needed by state legislation, although they might or might not have the ability to use any kind of price cuts or all the protection you desire - insurance companies.

These flat charges have a tendency to be low-cost, though as reduced as $15 in most cases. The actual price of an SR-22 in Florida or in any other state comes from the higher auto insurance coverage rates you might pay as a result of the driving infraction that triggered the SR-22 declaring. This is also truer when it concerns the cost of FR-44 insurance policy since it is tied to a DUI sentence.

department of motor vehicles auto insurance credit score insurance auto insurance

department of motor vehicles auto insurance credit score insurance auto insurance

If that chauffeur causes a mishap, though, his average automobile insurance policy rate jumps to $2,699 annually. That's $768 each year, or 40%, even more than what he would pay with a tidy record. ignition interlock. With a DUI on his record, our example driver paid approximately $2,821 per year for a full-coverage automobile insurance policy $890 per year greater than what a driver with a tidy document pays (sr-22).

sr22 sr-22 deductibles ignition interlock division of motor vehicles

sr22 sr-22 deductibles ignition interlock division of motor vehicles

It additionally offers the most inexpensive FR-44 insurance in the state. This is based on GEICO providing our example motorist with a DUI or an at-fault accident on his document the most inexpensive cars and truck insurance rates of the business we checked.

Your rates may vary. In this situation, the average yearly quote our example motorist with an at-fault crash received from GEICO was $742 for a full-coverage plan (division of motor vehicles). That's almost $1,000 annually more affordable than the ordinary quote we got from State Ranch, as well as a whopping $3,721 less costly than Allstate's average quote.

The 6-Second Trick For Sr-22 Car Insurance In Orange County - Criminal Defense ...

insurance auto insurance sr-22 insurance sr22 coverage motor vehicle safety

insurance auto insurance sr-22 insurance sr22 coverage motor vehicle safety

Florida's minimal auto insurance coverage demands are: An SR-22 confirms that your auto insurance coverage satisfies these minimal needs. The length of time is SR-22 required in Florida? You will require to have an SR-22 on file with the state for 3 years. That is the length of time most states need risky motorists to submit SR-22s, though some require it for longer.